- Evidence of name: You want an authorities-granted ID (particularly a driver’s license) otherwise a permanent citizen credit (Green Credit) if you’re a long-term citizen.

- Evidence of enrollment: Enjoys an effective transcript or other document including their title, school’s term along with your cumulative GPA (GPA just relates to borrowers within their sophomore year or beyond).

- Proof money: Copies of your several latest spend stubs during the last two months is necessary. Navy Government may consult a lot more evidence of income, based your income particular.

Your college or university will determine the newest loan’s disbursement go out and approve this new amount borrowed

Navy Federal will make sure their enrollment towards school you place in your app. The Navy Government education loan is going to be decreased so it matches your own school’s price of attendance count, once any extra educational funding try applied. Navy Federal will be sending money to their college as the mortgage is signed.

Should you want to refinance their student education loans that have Navy Government, you’ll also need to have the last declaration for every student loan you need to re-finance. It may need just as much as 2 weeks with the finance in order to disburse towards approved funds, but you need to keep and make repayments into the earlier lenders up until you get confirmation your own fund had been paid-in complete.

Navy Federal student education loans was private finance, making them shorter useful compared to the pros you can rating that have government student loans. Instance, federal education loan interest rates are often fixed minimizing than individual student loan prices.

At the same time, really federal figuratively speaking don’t require a cosigner otherwise credit check. Cost toward government children money will not initiate until you have accomplished college otherwise shed lower than 1 / 2 of-day status. Government college loans also provide flexible repayment plans, in addition to plans predicated on your income.

Government student education loans will in addition be entitled to Public-service Loan Forgiveness (PSLF), dependent on the type of really works along with your employer. For individuals who work complete-returning to an excellent United states government, condition, local otherwise tribal company, otherwise an effective nonprofit, while making 120 qualifying money, your whole federal student loan harmony could be forgiven.

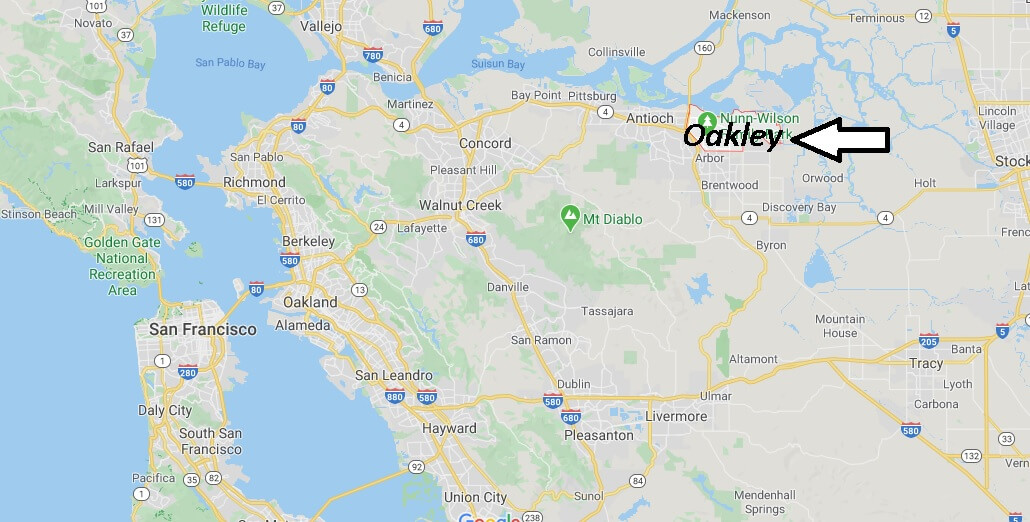

For people who go to college or university understanding we need to work for the latest You.S. armed forces or perhaps in public service once graduation, it seems sensible to get federal student loans basic so you may be entitled to PSLF. The fresh no credit check personal loans Oakland NJ U.S. army counts since the a qualified government manager into the PSLF system. This includes services with respect to the latest You.S. army or even the Federal Protect.

Eligible public service services are involved in personal elementary and you will supplementary universities, social child service organizations, and you may special government areas such public transportation, liquids, link otherwise homes government.

A strategic flow it thus deplete your government scholar financing solutions, and any scholarships or grants you should buy, before applying to possess a Navy Federal student loan or other private loan. Private figuratively speaking would be best accustomed fill the newest financial gap leftover shortly after your government school funding.

In the event that you re-finance the figuratively speaking that have Navy Federal?

Refinancing your student education loans is reasonable when the this often drop off the payment per month otherwise interest. It situation is probably for folks who just have individual fund.

You will want to think twice from the refinancing your federal student education loans, but not, particularly if you happen to be entitled to PSLF. You could potentially beat the advantages you enjoy having a national financing such loan forgiveness solutions, income-motivated repayment preparations, prolonged loan conditions and a lot more if you refinance all of them with a good personal loan. Refinancing the education loan would be of good use however, make certain the new positives provide more benefits than this new disadvantage.

For those who have a career regarding military or are usually planning to own one, you can make use of PSLF. Taking out an exclusive student loan will be your final resort in this situation. In the event that PSLF wouldn’t help you – particularly if you plan toward employed in the private industry otherwise you might be credit enough to sit in area college, including – you really need to however turn-to federal student loans earliest right after which use only what you need of an exclusive financial such as for instance Navy Federal.

Tổng lượt truy cập : 211524

Tổng lượt truy cập : 211524 Đang truy cập : 51

Đang truy cập : 51