A connection financing is an option you to definitely encourages the acquisition out-of an alternative home prior to offering your home.

Based your geographical area regarding condition, median houses cost during the Texas vary from $313,000 for the towns like San Antonio so you can $450,000 in portion including Austin-Round Stone. Highest interest levels made conversion frequency decrease, however, pricing have gone up-over the very last 12 months. This is partially due to the fact that collection isnt maintaining demand.

Many of these issues suggest seeking lock in the acquisition of the property you desire, wherever you’re in product sales procedure for the current family. Despite their higher cost, a connection mortgage can offer particular experts. Let us remark brand new upsides.

You are able to a low-contingent give in your new house

Whenever an offer are contingent on the consumer selling the latest household, it’s not as the aggressive once the a non-contingent provide. A contingency try an expression otherwise standing that must be satisfied before sales should be accomplished. Of several people having a home to sell were a revenue contingency on their has the benefit of. When you look at the a competitive seller’s industry, the seller could possibly get like an excellent clean promote, free of contingencies, to help you accelerate the newest income.

Approximately half of all of the people already own a house, thus contingencies all are. When you find yourself simply to 5% of contracts is actually terminated on account of backup situations, of several vendors nonetheless want to take on now offers instead of contingencies.

Heidi Daunt, branch movie director and you will holder off Treehouse Home loan Group, says, If you have a prescription link mortgage, you could develop a low-contingent render, that it provides you with top settling fuel in your the brand new purchase.

Centered on Keeton, For folks who check out a vendor and you can state, Could you wait until I sell my house?’ these days, they probably say No.’ A link loan is a means for you to need power over you to home and that means you dont beat it to another customer.

You merely need circulate shortly after

In the event the homeowner possess sold their home ahead of to be able to purchase a separate you to, they are obligated to transfer to a preliminary-identity local rental. Along with the added inconvenience out of swinging twice, there is extra will cost you. According to , the common rates to have a shift are $nine,060. Multiply one to from the two if you have to discover a temporary family as you do not have a link loan to move individually in the new house.

Often that which you want to do try promote your residence, go on to a condo, buy another domestic, following circulate again. A bridge financing assists end that, Keeton states, exactly who works together with more than 75% a great deal more single-family unit members homes as compared to average representative in the markets.

You might ready your old house on the market immediately after venturing out

In case the provider spends a bridge loan to move to their new home, it does let them have a clean record to obtain their dated family happy to number, having shorter tension much less in the way.

Specific lenders don’t need costs when you look at the financing months

Should you get a loan provider who lets a grace months to help you defer payments, otherwise who charge desire-merely towards the a link financing, it will convenience the latest financial discomfort and come up with a connection financing a great deal more smoother.

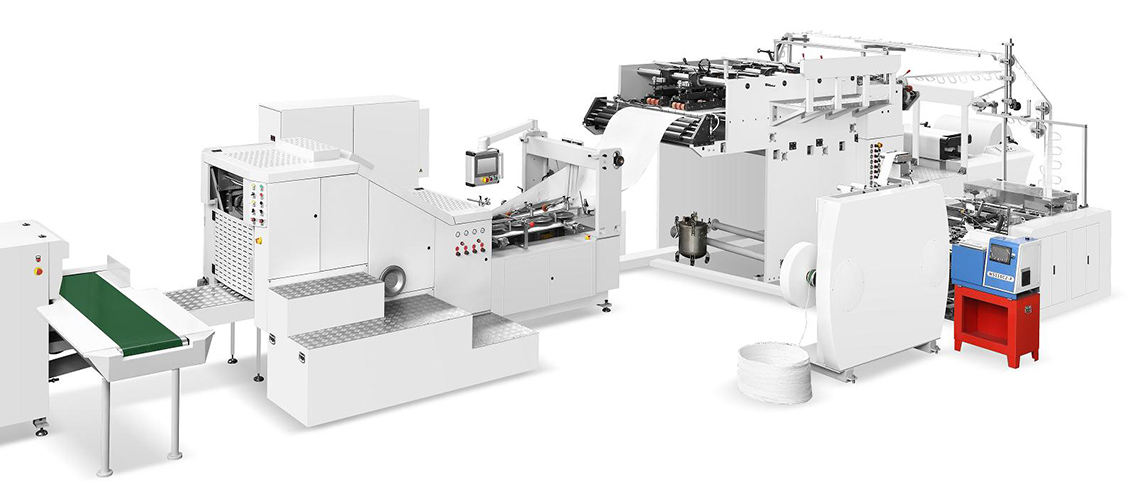

You can purchase funding for material and you will gizmos for build.

Should your brand new home you happen to be transferring to is new build or a restoration, a bridge financing offer money buying product and you will gadgets to accomplish the task.

Do you know the risks of a bridge financing?

It’s important to weigh the huge benefits and you may cons of any monetary strategy. A link mortgage can be an excellent substitute for make it easier to thanks hop over to the website to a difficult a home purchase, however it is maybe not suitable for someone in every circumstance. Several things to consider is:

Tổng lượt truy cập : 177666

Tổng lượt truy cập : 177666 Đang truy cập : 33

Đang truy cập : 33